How to Optimize the Advantages of a Secured Credit Card Singapore for Financial Development

How to Optimize the Advantages of a Secured Credit Card Singapore for Financial Development

Blog Article

Introducing the Possibility: Can People Released From Bankruptcy Acquire Credit Cards?

Recognizing the Impact of Insolvency

Upon filing for bankruptcy, people are challenged with the considerable repercussions that permeate numerous facets of their monetary lives. Personal bankruptcy can have a profound influence on one's credit history, making it testing to accessibility credit score or lendings in the future. This economic discolor can linger on credit history reports for numerous years, affecting the person's capacity to secure positive rate of interest or monetary chances. Furthermore, bankruptcy might cause the loss of possessions, as specific possessions may require to be liquidated to repay lenders. The psychological toll of bankruptcy should not be ignored, as people may experience feelings of embarassment, regret, and stress due to their monetary situation.

In addition, bankruptcy can limit employment possibility, as some employers carry out credit report checks as part of the employing procedure. This can posture an obstacle to individuals looking for brand-new task potential customers or career improvements. Generally, the impact of bankruptcy prolongs beyond economic restraints, affecting numerous facets of an individual's life.

Factors Impacting Charge Card Authorization

Adhering to bankruptcy, individuals often have a low credit score due to the negative impact of the bankruptcy filing. Credit card companies generally look for a credit history rating that demonstrates the applicant's capability to take care of credit responsibly. By carefully considering these factors and taking steps to rebuild credit history post-bankruptcy, individuals can improve their prospects of acquiring a credit rating card and working towards economic recuperation.

Actions to Restore Debt After Personal Bankruptcy

Restoring credit rating after personal bankruptcy calls for a calculated method concentrated on economic self-control and consistent financial debt administration. The first action is to examine your debt report to make certain all financial obligations included in the insolvency are accurately reflected. It is necessary to establish a spending plan that prioritizes debt payment and living within your ways. One effective approach is to get a protected bank card, where you transfer a certain quantity as security to establish a credit rating limitation. Timely settlements on This Site this card can demonstrate liable credit history use to prospective lending institutions. Additionally, take into consideration ending up being an accredited individual on a relative's bank card or checking out credit-builder loans to additional improve your credit report. It is essential to make all repayments on time, as repayment history dramatically impacts your debt score. Persistence and determination are vital as rebuilding debt takes time, however with dedication to sound monetary methods, it is possible to improve your creditworthiness post-bankruptcy.

Secured Vs. Unsecured Credit Report Cards

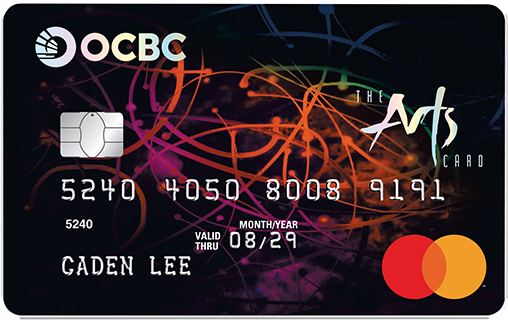

Complying with insolvency, people usually think about the option between safeguarded and unsafe credit rating cards as they aim to restore their credit reliability and economic stability. Protected credit rating cards call for a money down payment that serves as collateral, commonly equivalent to the credit scores limit granted. Inevitably, the option between click here to find out more secured and unsafe credit score cards must line up with the individual's economic objectives and capacity to handle credit report properly.

Resources for Individuals Looking For Credit Restoring

For individuals aiming to enhance their creditworthiness post-bankruptcy, exploring offered sources is critical to successfully navigating the credit scores restoring procedure. secured credit card singapore. One valuable resource for individuals seeking credit rebuilding is credit report therapy agencies. These organizations provide monetary education and learning, budgeting aid, and personalized credit history renovation strategies. By collaborating with a credit rating counselor, individuals can get understandings right into their credit scores reports, discover approaches to boost their credit history, and obtain assistance on handling their financial resources properly.

One more useful source is credit surveillance solutions. These services permit people to keep a close eye on their credit rating records, track any type of errors or modifications, and detect possible signs of identification theft. By checking their credit history frequently, people can proactively deal with any kind of problems that might occur and make certain that their debt info depends on day and exact.

Additionally, online devices and resources such as credit rating simulators, budgeting applications, and financial proficiency sites can give individuals with beneficial information and devices to aid them in their credit score rebuilding trip. secured credit card singapore. By leveraging these resources efficiently, people discharged from personal bankruptcy can take significant actions in the direction of boosting their credit rating health and wellness and protecting a better monetary future

Final Thought

In verdict, people released from bankruptcy may have the chance to acquire bank card by taking actions to rebuild their credit history. Aspects such as credit rating earnings, background, and debt-to-income ratio play a considerable function in debt card authorization. By recognizing the influence of bankruptcy, choosing between safeguarded and unsafe bank card, and utilizing resources for credit scores rebuilding, individuals can improve their creditworthiness and possibly acquire accessibility to charge card.

By working with a credit report therapist, individuals can acquire insights into their credit history reports, discover techniques to enhance their credit rating scores, and obtain assistance on managing their funds effectively. - secured credit card singapore

Report this page